Canaras Research Insight

Recently, an article was published in the WSJ captioned “Junk-Loan Defaults Worry Wall Street Investors.” The premise of the article was that amidst rising interest rates corporate loan borrowers will experience increasing difficulty servicing their loans and ultimately begin to default in greater frequency. A few days prior, a similar article was also published in the Financial Times on the high-yield (“HY”) bond market captioned: “US Junk Bond Sell-off Resumes After the Fed Snaps Summer Rally,” with a similar premise that discussed rising corporate debt service against a looming recession.

The foundation behind both articles is solid, and the market should continue to see increasing debt service pressure on all unhedged borrowers in the corporate debt markets. Similarly, that burden combined with recession pressures will force certain businesses already in a tight liquidity position to restructure.

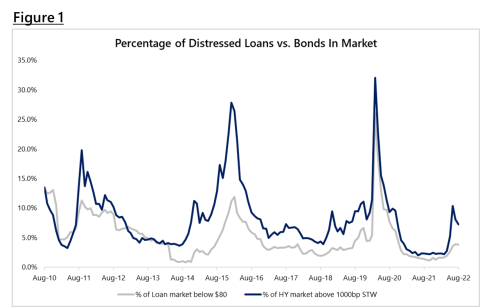

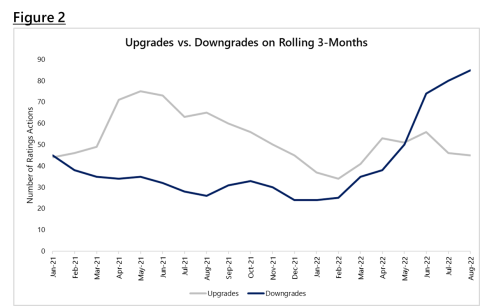

The HY bond and corporate loan markets are actively pricing in the increased risk, as evidenced by the movement we have seen in Distressed Ratios as shown in Figure 1, although we note current Distressed Ratios and corporate default rates remain well below historic levels. The HY Distressed Ratio is a percentage of bonds trading at or above a discount margin (“DM”) of 1,000 basis points, while the corporate loan Distressed Ratio is a percentage of corporate loans trading below 80 cents on the dollar. This pressure has also been evident in ratings agencies’ upgrades vs. downgrades of corporate debt issuers, as shown in Figure 2 below.

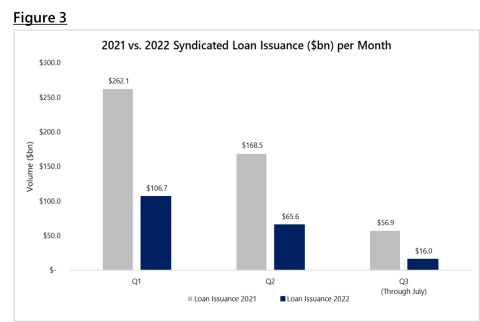

Severity of risk should always be higher for HY bonds (and therefore they should display a higher Distressed Ratio in the chart above) because of their fixed interest rates that are more subject to interest rate volatility compared to floating rate corporate loans. HY bonds are rarely secured by the assets of the issuing company, unlike corporate loans, which adds additional volatility to HY bonds. Furthermore, the HY bond and corporate loan markets have effectively been closed for new issue since May 2022, as underwriters and market participants determine higher spread requirements given the increased possibility of loss through defaults. Figure 3 below demonstrates Y/Y corporate loan issuance volume decline.

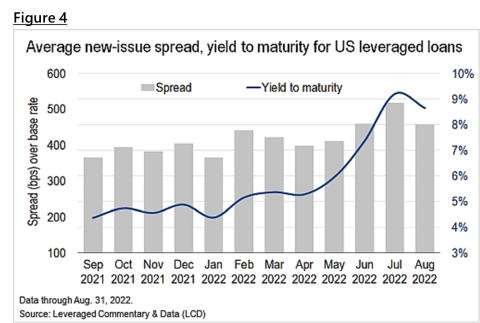

Corporate loans, through their relatively short average life, tend to reprice risk more frequently than HY bonds. Corporate loans typically see many re-pricing or fee events as borrowers return to the lending syndicate to make changes in terms and conditions, frequently relating to covenants. Over the next 6 months, this trend could further accelerate with the government-mandated migration from LIBOR to SOFR, which is required to be completed by summer 2023. These factors could present an opportunity to investors to request an adjustment to pricing upwards on many names in their portfolios to better reflect increased investment risks, and this upward trend has already begun as seen in Figure 4.

Finally, corporate loan issuers almost always provide financial budgets and other confidential quarterly reconciliations of performance to CLO managers such as Canaras. Budgets and reconciliations help investors better assess risk throughout the life of the investment and react accordingly to requests from issuers based on changes in markets and the dynamic investment environment.

In summary, corporate loans are different from HY bonds in their ability to adjust yields both through their floating interest rates and through the potential to widen spread frequently to adjust to increasing credit risk. This unique set of characteristics has allowed the corporate loan asset class to, over the years, perform more reliably as a component of mutual funds, CLOs, and closed-end funds.